Bond Convexity: Your Secret Weapon for Navigating Interest Rate Risk

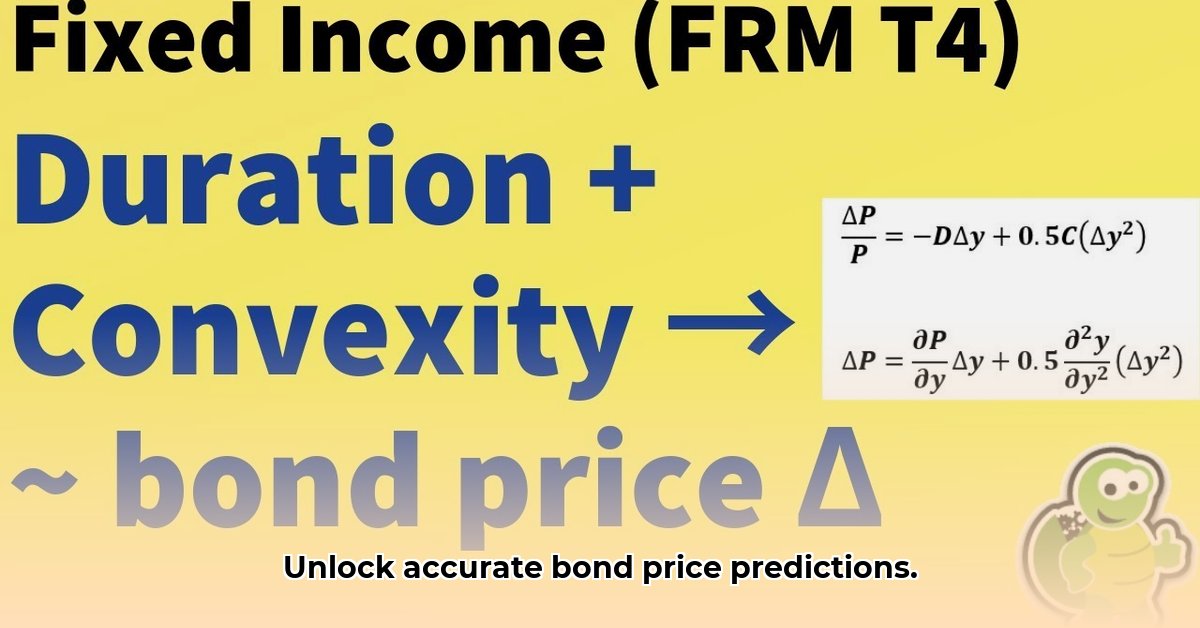

Understanding how bond prices react to interest rate changes is critical for investors. Duration provides a basic measure of this sensitivity, but it's a simplified view. Bond convexity offers a more nuanced understanding, revealing the curvature of the relationship between interest rates and bond prices. Mastering this concept significantly enhances your ability to predict price movements and manage risk effectively. This guide will equip you with the knowledge and tools to utilize bond convexity for smarter investment decisions.

What is Bond Convexity?

Imagine a curve. Unlike duration, which assumes a linear relationship between interest rates and bond prices, convexity accounts for the non-linearity – that curve. When interest rates fall, bond prices rise, and convexity measures how much extra price appreciation occurs beyond what duration predicts. Conversely, when rates rise, convexity quantifies the dampening effect on price declines – the "cushion" against losses. Higher convexity means greater price gains when rates fall and smaller price drops when rates rise. It's a crucial refinement in assessing interest rate risk.

A simple analogy: Think of two bonds with equal duration. One has high convexity, the other low. If interest rates drop 1%, the high-convexity bond will likely appreciate more than the low-convexity bond. If rates rise 1%, the high-convexity bond's price will likely drop less than the other. This non-linearity is the essence of convexity.

Calculating Bond Convexity: A Step-by-Step Guide

Calculating bond convexity directly can be complex, particularly for bonds with embedded options. However, readily available online calculators simplify the process significantly. Here’s a step-by-step guide:

Gather Data: You'll need the bond's Yield to Maturity (YTM) (the total return expected if held until maturity), modified duration (a measure of price sensitivity to interest rate changes), and Macaulay duration (a weighted average time until cash flows are received). This information is typically available from bond information websites or brokerages.

Choose a Calculator: Several reputable online bond convexity calculators are available. Ensure you understand the calculator's assumptions and limitations.

Input Data: Carefully enter the YTM, modified duration, and Macaulay duration. Double-check your entries to avoid errors.

Interpret Results: The calculator will output the bond's convexity—a numerical value representing the curvature of the price-yield relationship. Higher values indicate greater sensitivity to interest rate changes.

Example: Let's say a bond has a YTM of 5%, Macaulay duration of 7, and modified duration of 6.5. Inputting these values into a calculator might yield a convexity of 45. Such a result indicates substantial sensitivity to interest rate movements.

Interpreting Convexity Results: High vs. Low

A higher convexity signifies greater price appreciation when rates fall and smaller price declines when rates rise. But it's crucial to remember that higher convexity doesn't automatically equal "better." It simply means more responsiveness to interest rate swings – both positive and negative. The optimal level of convexity depends on your overall investment strategy and risk tolerance. High convexity might be desired when anticipating rate cuts, while lower convexity could be preferable during periods of uncertainty.

Using a Bond Convexity Calculator: A Practical Guide

Most calculators require the following inputs:

- Yield to Maturity (YTM): Your expected return if you hold the bond until maturity.

- Coupon Rate: The annual interest payment relative to the bond's face value.

- Time to Maturity: The time remaining until the bond matures.

- Par Value (Face Value): The amount repaid at maturity.

After inputting this data, the calculator provides the convexity value. Remember that slight variations in results might occur across different calculators due to variations in calculation methodology.

Limitations of Convexity: What You Need to Know

While valuable, convexity has limitations:

- Constant Yield Curve Assumption: Real-world yield curves are dynamic, not static.

- Small Interest Rate Change Assumption: Convexity's accuracy decreases with large rate fluctuations.

Therefore, don't rely solely on convexity. It's one piece of the risk assessment puzzle, best used in conjunction with duration, other risk metrics, and a broader understanding of the market environment.

Real-World Applications: Putting Convexity to Work

Consider a portfolio manager aiming to anticipate a decrease in interest rates. Understanding convexity allows them to strategically select bonds with higher convexity, expecting greater price appreciation when their prediction is correct. They would prioritize bonds with greater convexity to potentially increase the portfolio's returns. Conversely, during periods of rising rates, bonds with lower convexity might be preferred to minimize losses. This adds a dimension of precision to portfolio construction and risk management.

For individual investors, analyzing convexity enables more educated bond selections aligning with their risk tolerance and investment horizon.

Conclusion: Convexity as Part of a Broader Strategy

Bond convexity, while not a crystal ball, provides valuable insights into interest rate risk. Used thoughtfully in conjunction with duration and other analytical tools, it significantly improves investment decision-making. Remember, however, that market conditions are dynamic and unpredictable. No single metric guarantees success. Treat convexity as a vital tool within a broader, well-informed investment strategy.

Resources

- Link to a reputable bond analysis website

- Link to another relevant resource